The increased attention to carbon footprints and the adoption of sustainability commitments have led to major increases in demand for renewables among commercial, industrial, and institutional customers. Innovations in the structuring of renewable energy power purchase agreements have drastically increased the accessibility of renewable energy projects to corporate energy buyers. The main advancement in corporate renewable energy procurement has been the creation of new and creative structures known as Power Purchase Agreements (PPAs), that allow for renewable energy purchases from large, off-site projects. This article focuses on describing the most common types of power purchase agreements —the Virtual PPA (Synthetic PPA), the Retail PPA, and the Utility Sleeved PPA.

What Are Renewable Energy Power Purchase Agreements?

A Power Purchase Agreement (PPA) is a long-term contract between a renewable energy project and a power buyer, in which the buyer agrees to purchase the project’s energy for a fixed price during the contract tenor. Earlier renewable energy PPAs had terms of 20 years, but tenors have declined to 15, 12 and even 10 years to meet buyer demands.

How do PPAs Work?

Under the PPA structure, a third party provides the upfront investment to pay for the project and in return, receives a contracted long-term revenue stream from the energy buyer as well as all other available incentives. The corporate energy buyer receives a fixed rate for energy, usually at a discount to what they are already paying, without having to put up capital to build the project.

Types of Power Purchase Agreements for Offsite Renewable Energy Projects

There are a few different types of power purchase agreements to be aware of; Virtual PPAs, Retail PPAs, and the Utility Green Tariff Program.

What is a Virtual PPA (Synthetic PPA)?

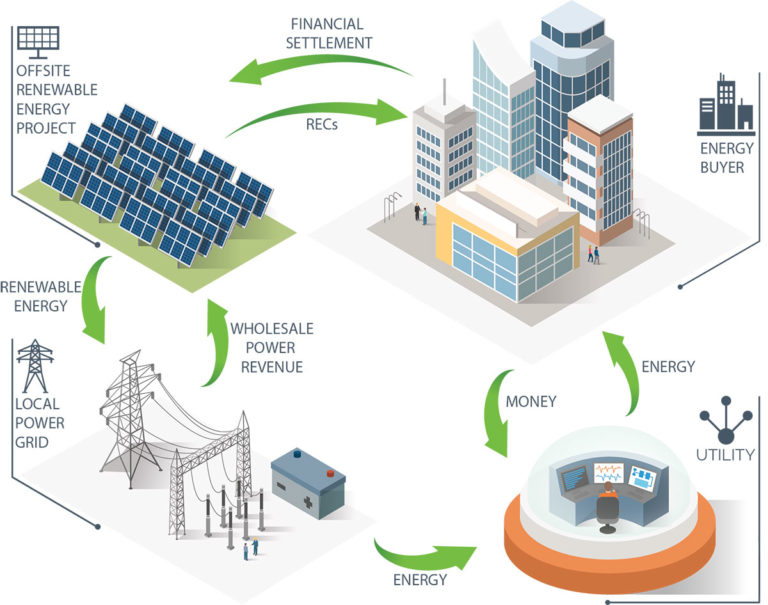

The Virtual Power Purchase Agreement (VPPA), also known as a synthetic PPA) is a contract structure under which a buyer (or offtaker) agrees to purchase the project’s renewable energy for a fixed price, while the project receives the floating market price. If the fixed VPPA price is greater than the actual market price, then the project pays the difference to the offtaker. If the market price is greater than the VPPA price, then the project company keeps the difference. In this way, a VPPA is a financial hedge against volatile electricity prices. In a Virtual PPA, the buyer typically receives the project’s Renewable Attributes but does not take physical delivery of the energy. The buyer/offtaker continues to purchase its electricity through their local utility. A utility-scale solar VPPA enables large electricity consumers with fragmented/distributed electric loads to realize the benefits of renewable energy.

What is a Retail/Direct/Sleeved Power Purchase Agreement?

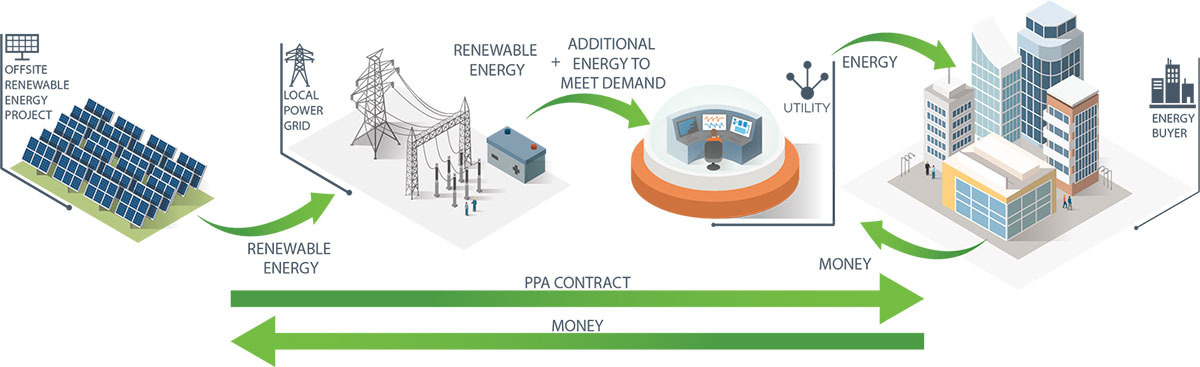

Another offsite power purchase agreement structure in use today is the Retail PPA. Also called a “Direct PPA” or “Sleeved PPA” this structure is suitable in de-regulated electricity markets where customers have retail choices, such as Maryland. Under this structure, the buyer enters a power purchase agreement with its retail electricity supplier and takes both the delivery and title to a project’s energy. The benefit of this structure is that the retail electric supplier takes on the market risks associated with wholesale electricity, and the customer gets a fixed price for the energy. Unfortunately, because these contracts are only available to customers in deregulated markets, the amount of renewable energy procurement is restricted to the buyer’s total load within those markets.

What is a Utility Green Tariff Program?

A utility green tariff program is another form of a Sleeved PPA that has been gaining momentum over the last year in regulated electricity markets. Typically, PPA sleeving programs are set up through a regulated utility’s rate structure. The utility, with approval from the state public utility commission, offers customers renewable energy through a “Green Tariff”. Like the Retail PPA, with a Sleeve PPA, the utility wears the whole market pricing risk and delivers renewable energy and in many cases the Renewable Energy Credits (RECs), to the customer for a fixed rate. Often the greatest downside to this structure is that customers will pay a premium for renewable energy in exchange for the utility taking on the market risk.

Which PPA is Right For Your Renewable Energy Goals?

Today, PPA’s are a key driver in the widespread deployment of utility-scale solar projects in the United States. While there are trade-offs and varying risks among the types of power purchase agreements, a solar PPA requires no capital investment, carries no maintenance costs, and locks in energy prices for up to 25 years. Renewable energy PPAs put clean energy into the electric grid, and the offtaker owns all the environmental benefits associated with its portion of the project. This is great news in a volatile energy market and for buyers looking to meet renewable energy and sustainability goals.

If you’d like to discuss how a utility-scale solar PPA could help you meet your corporate renewable energy goals, call us at (866) 256-0912 .